Income Tax Bracket Philippines - Income Brackets Philippines 2019 - PASIVINCO : We provide a visual guide to help taxpayers prepare and submit their income tax returns (itrs) in the philippines, from manual filing, efps, and ebirforms.

Income Tax Bracket Philippines - Income Brackets Philippines 2019 - PASIVINCO : We provide a visual guide to help taxpayers prepare and submit their income tax returns (itrs) in the philippines, from manual filing, efps, and ebirforms.. The philippines uses a tax bracket system, each bracket is taxed a set amount and then a further set percentage on excess earned over that amount. Each tax rate applies to a specific range of income referred to as a tax bracket. where each tax bracket begins and ends depends on your filing status. This is the tax you are still liable at the end of the year. The first step is you should answer the following questions below answer: About 1,660,000 results (0.80 seconds).

Rodrigo duterte on december 19, 2017 and its implementation began on january 1, 2018. Federal income tax brackets are determined by income and filing status. You are probably aware of the train law or the republic act no. There are seven income tax brackets, ranging from 10% to 37%. How to qualify for a lower tax bracket.

Computing income tax expense and payable is different for individuals and corporations.

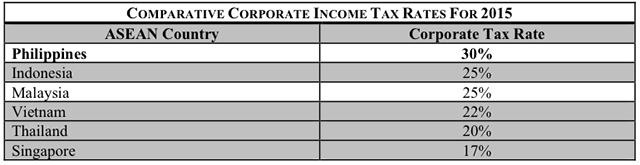

How to prepare and submit your income tax returns in the philippines. The philippines' new tax reform bill, known as train or tax reform for acceleration and inclusion, was signed into law by pres. Every year, individuals and enterprises in the philippines pay their. Calculate and find out here! The higher rates only apply to the upper portions of your income. Train law has come into existence. Basics of income tax computation. Taxable corporations may be taxed using a fixed income tax rate. All images news shopping maps more settings tools. The philippines, having the 2nd highest income tax in asean, have amended its 20 year old tax code as promised by its current president during his electoral campaign. All income tax information is summarized by r.g. Make your tax filing a whole lot easier with a tax calculator for philippine tax forms. With this let us try to compare and understand this new amendments and how it will affect.

Compute your income tax payable. Every year, individuals and enterprises in the philippines pay their. All images news shopping maps more settings tools. Federal income tax brackets are determined by income and filing status. This one falls into column 2 or bracket 2 (whatever you want to call it).

10963, which is also known as the tax reform for acceleration and as a continuation of your example, since the taxable income is ₱23,400.

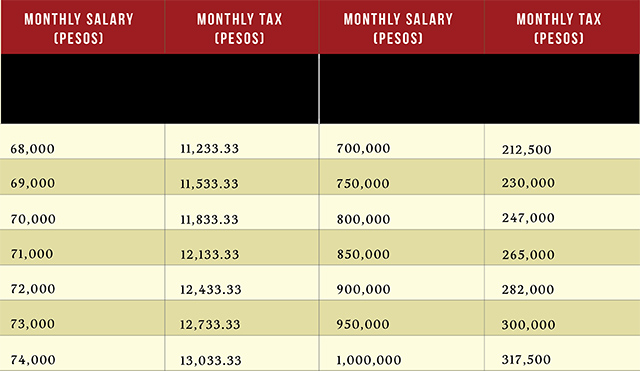

How to qualify for a lower tax bracket. Did you know that you may not pay the same tax rate on all your income? Of course there is a way on finding your corresponding bracket or exemption and %over given your taxable income but i will not introduce it here since it is a long process that. Code to add this calci to your website. Computing income tax expense and payable is different for individuals and corporations. Each filing status has its own tax brackets, but the rates are the same for all filing below are income tax bracket and rate tables. 2019 federal income tax brackets. The philippines taxes its resident citizens on their worldwide income. How will the train law affect income taxes of individuals and corporations? Income tax for philippines is the individual income tax consists of taxes on compensation income (from employment), business income, and passive income (interests, dividends, royalties, and prizes). The irs divides your taxable income into portions, or brackets. Income tax table for 1 january 2018 to 31 december 2022. 1,000,000 falls under the 800,000 lower limit bracket.

A person is considered a resident if. Employees deriving purely compensation income. How will the train law affect income taxes of individuals and corporations? How to prepare and submit your income tax returns in the philippines. You are probably aware of the train law or the republic act no.

Company tax is payable by domestic companies.

What's the income tax on residential lettings in philippines? However, it's important to understand that your entire income is not taxed at your tax bracket rate. How to qualify for a lower tax bracket. Compute your income tax payable. A tax bracket is a range of income amounts that are taxed at a particular rate. You can calculate your personal income tax rates with the efile.com rateucator by tax year. Workers earning less than ₱21,000 a month will be exempted, because their salary is less than the lowest tax brackets implemented in the new tax reform. With this let us try to compare and understand this new amendments and how it will affect. Uses a graduated tax system, which means that taxpayers pay an increasing rate as their income rises. Which federal income tax bracket are you in? 10963, which is also known as the tax reform for acceleration and as a continuation of your example, since the taxable income is ₱23,400. Train law has come into existence. How does the 2018 tax reform affect your taxes?

Komentar

Posting Komentar